Property market expert, Kate Faulkner, reports a clear divide between the North and South of England when it comes to house price performance.

11th Feb 20260 438 3 minutes read Kate Faulkner OBE The regional property market outlook continues to show a clear divide between the North and the South.

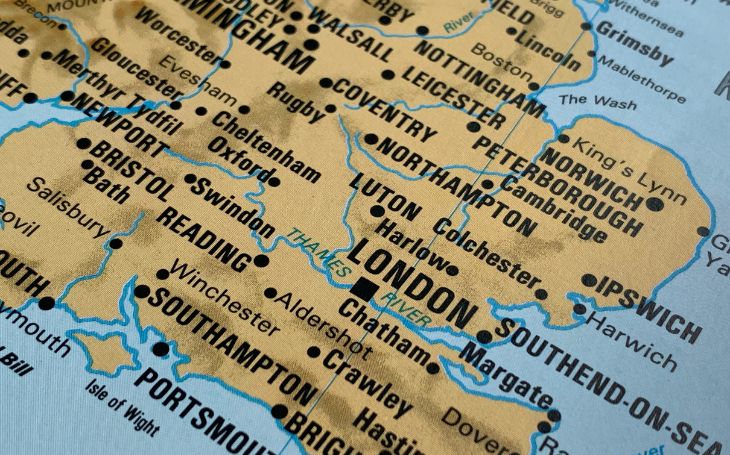

The regional property market outlook continues to show a clear divide between the North and the South.

Higher mortgage rates are having a far greater impact on affordability down south than up north, and this is feeding directly through into price performance.

The North East continues to post the strongest price rises across the various indices. By contrast, London is still seeing price falls and the South West also remains in negative territory.

As always in property, there are winners and losers. At present, those most likely to benefit are first-time buyers and home movers looking to trade up.

In the South and East, the drag that higher mortgage rates have had on prices is creating opportunities that simply haven’t existed for some time. For many buyers, this may prove to be a rare window to get on – or move up – the housing ladder.

In the South and East, the drag that higher mortgage rates have had on prices is creating opportunities that simply haven’t existed for some time. For many buyers, this may prove to be a rare window to get on – or move up – the housing ladder.

Comparing the performance of regions reported by regions, Nationwide and UK HPI show the majority of regions are seeing prices continue to rise, while indices which measure the market more recently – Rightmove and Home.co.uk are only reporting 5 to 6 regions rising, showing how measuring the property market at different times during the house moving process can impact on whether a market is rising or falling.

Commentary from the indices on the regional performance:Zoopla

“The strongest price growth in Britain is concentrated in northern England and Scotland, including the Scottish Borders (4.7%), Oldham (4.4%), Kirkcaldy (4.2%) and Falkirk (4.2%), with further upside expected in 2026.

“In contrast, prices are easing across parts of southern England, particularly coastal markets where double council tax on second homes and a return to office working are dampening demand. Truro is down 2.4%, with smaller declines in Torquay (TQ, -1.9%) and Bournemouth (BH, -1.8%).

“London prices are softer in inner areas, with declines of up to 2% in parts of the west, reflecting high values and stamp duty costs. Most outer London markets, however, continue to see modest price growth of up to 1%.

“A clear north–south divide persists. Prices are flat to slightly lower in southern England, down up to 0.6%, where affordability pressures are greatest. In contrast, lower prices in northern England and Scotland are supporting stronger growth, with inflation reaching 2.9% in the North West. This divide is expected to continue into 2026.

“This trend is reflected in first-time buyer behaviour, with buyers targeting cheaper homes in London and the South, while paying more in regional markets, reinforcing faster price growth outside the South.”

Home.co.uk

“Regional variation during the last month prices fell in all English regions (except London, the North West and the North East), Wales and Scotland. The largest falls were in the East of England and the South West (see map), while the largest gain was in the North East.

“Annualised growth is now negative in three regions, namely London, the South West and the East of England. We anticipate that more regions will suffer the same plight in 2026.

“Our comprehensive data shows that one of the best predictors for price adjustments is the change in Typical Time on Market for unsold property. Regions that are picking up the pace will experience price gains while slowing markets will correct. Therefore, as we head into the new year, we expect prices in the South West,

“Greater London and the South East to come under the greatest downward pressure. The North East, meanwhile, as the only regional market to have accelerated over the last twelve months, may well increase its nominal growth.

“Other formerly top-performing northern regions will likely continue to indicate weak, sub-inflation, annualised price growth. The search for higher yields was the key driver for growth in the northern regions but, with rents sliding, negative real capital gains, anti-landlord legislation, spiralling running costs and additional tax on rental income, the party is all but over.”

Halifax

“In England, the North East had the highest annual growth rate, as property prices rose by +3.5%, to £181,798. This was followed by the North West, which saw growth of +2.8%, to £245,323. Property prices in London fell by -1.3% over the course of 2025 to £539,086.”

Tagshouse prices 11th Feb 20260 438 3 minutes read Kate Faulkner OBE Share Facebook X LinkedIn Share via Email