- News

- UK

- UK Politics

The chancellor has unveiled £26bn worth of tax rises in the Commons as she attempts to plug a multi-billion pound gap in Britain’s ailing public finances

Millie CookePolitical Correspondent,Caitlin DohertyWednesday 26 November 2025 13:13 GMTComments

CloseRachel Reeves responds to 'deeply disappointing' OBR Budget leak

CloseRachel Reeves responds to 'deeply disappointing' OBR Budget leak

Sign up for the View from Westminster email for expert analysis straight to your inbox

Get our free View from Westminster email

Get our free View from Westminster email

Email*SIGN UP

Email*SIGN UPI would like to be emailed about offers, events and updates from The Independent. Read our Privacy notice

After months of speculation and briefings, the chancellor’s Budget has been unveiled in the Commons today. But in an unprecedented leak just minutes before Rachel Reeves got to her feet, the Office for Budget Responsibility (OBR) published its response to the statement, leaking her entire plan before she even had a chance to unveil it.

The report shows she will unveil £26bn worth of tax rises at today's Budget, leaving her with £22bn in fiscal headroom.

The tax hikes, which come on top of the £40bn of tax rises unveiled last year, as set to be delivered by freezing personal tax thresholds and a host of smaller measures. It brings the tax take to an all-time high of 38 per cent of GDP in 2030-31.

Here are the key takeaways from the chancellor’s long-awaited – but much-trailed – budget.

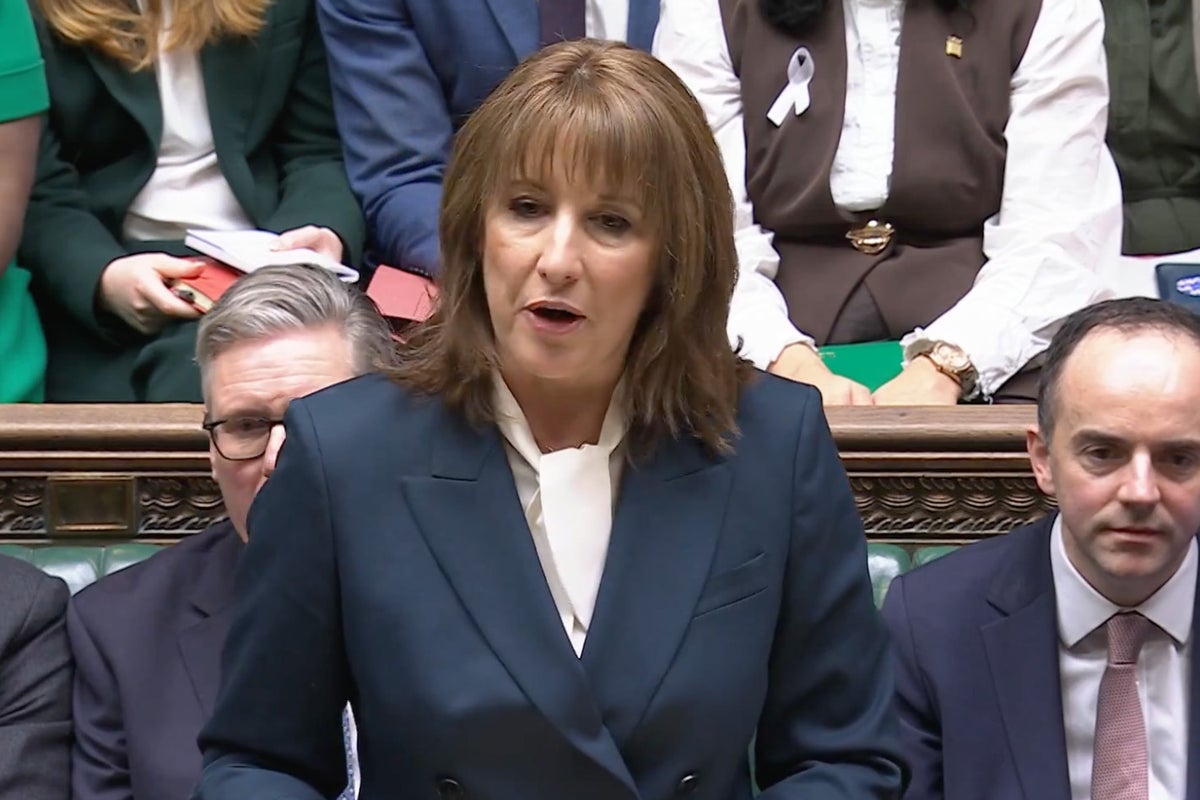

Rachel Reeves is unveiling her Budget in the Commons (Parliament TV)

Rachel Reeves is unveiling her Budget in the Commons (Parliament TV)Economic growth

The OBR has predicted that economic growth will be weaker than expected from 2026 to the end of the current Labour government, despite having increased its forecast for economic growth this year from 1 per cent to 1.5 per cent.

In 2026, growth has been downgraded from 1.9 per cent to 1.4 per cent, in 2027 from 1.8 per cent to 1.5 per cent, in 2028 from 1.7 per cent to 1.5 per cent and in 2029 from 1.8 per cent to 1.5 per cent.

The news will come as a blow to the Labour government, which has put economic growth at the heart of its mission in office.

Inflation and unemployment are also set to be higher than expected in 2025 and 2026, as the tax burden continues to rise.

Tax rises

A freeze on income tax thresholds

Rachel Reeves has announced that income tax thresholds have been frozen for three more years until 2030 -31, a move previously described as a “stealth” tax rise.

This will drag more people into paying the tax for the first time, and others into paying a higher rate as wages rise.

The OBR said the freeze would result in 780,000 more people paying the basic-rate, 920,000 more the higher-rate and 4,000 more additional-rate income tax payers in 2029/30, and estimated it will raise around £7.6bn in 2029/30.

Pension tax raid

Pension contributions made under salary sacrifice schemes of more than £2,000 per year will now be hit with national insurance contributions from 2029, for both employers and employees, the chancellor announced.

The move is expected to raise £4.7 billion in 2029/30 and £2.6 billion in 2030/31. At the moment, there is no limit.

Mansion tax

All properties worth more than £2m will be slapped with a new property tax of around £4,500. According to the OBR, "from April 2028, owners of properties identified as being valued at over £2 million by the Valuation Office (in 2026 prices) will be liable for a recurring annual charge which will be additional to existing council tax liability".

The document says that there will be four price bands, starting from a £2,500 charge for properties worth between £2million and £2.5million, and rising to £7,500 for properties worth £5million or more.

Pay-per-mile

Rachel Reeves will announce a mile-based tax for electric cars.

According to the Office for Budget Responsibility's document, in 2028-29 the charge will equate to 3p per mile for battery electric cars and 1.5p per mile for plug-in hybrids.

This means that the average driver of a battery electric car in 2028-29, driving 8,500 mile,s is expected to be charged £255 for that year, according to the watchdog.

Sugar tax

Pre-packaged milkshakes and lattes will be subject to the sugar tax, as the chancellor and health secretary ended the exemption for milk-based beverages from the existing tax on sugary drinks.

The move will affect products such as packaged milkshakes, coffees and sweetened yoghurt drinks but not drinks made on site in cafes and restaurants.

The threshold for levy will also be cut from 5g/100ml to 4.5g/100ml, hitting dozens more popular brands, including Pepsi, Irn Bru and Fanta

Tourist Tax

Local mayors will be allowed to impose a “tourist tax” on overnight stays, the government announced the night before the budget, as part of an attempt to put more money into England’s cities and regions.

Mayors will be given the power to levy a “modest” charge on visitors staying in hotels, bed and breakfasts, guest houses and holiday lets.

The plans will be subject to a consultation running until 18 February, which will consider issues including whether there should be a cap on the size of the levy.

Cost of Living measures

Two-child benefit cap scrapped

The government has decided to lift the two-child benefit cap, a measure which the fiscal watchdog says will cost £3bn by 2029-30.

After months of back and forth on the issue, and growing pressure from Labour backbenchers, the government has finally decided to lift the controversial cap – a move the OBR estimates will increase benefits for 560,000 families by an average of £5,310.

National living wage

The national living wage has been hiked to £12.71 for workers aged 21 and over - an increase of 4.1 per cent. The government said this will increase gross annual earnings of a full-time worker on the rate by £900. Meanwhile, the National Minimum Wage rate for 18 to 20-year-olds will increase by 8.5 per cent to £10.85 an hour, narrowing the gap with the National Living Wage.

This will mean an annual earnings increase of £1,500 for a full-time worker, which the government said marks further progress towards its goal of phasing out 18 to 20 wage bands and establishing a single adult rate.

Transport

The chancellor will extend the fuel duty freeze for another year, which the OBR estimates will cost £2.4 billion next year and £0.9 billion in the medium term.

The tax has been held at 57.95p since 2011, but the effective rate paid by drivers since 2022 has been 52.95p as a result of a “temporary” 5p cut.

And for the first time in 30 years, Rachel Reeves has frozen rail fares for one year – instead of allowing them to rise in line with inflation.

More about

Office for Budget ResponsibilityTaxtax risesChancellorBudgetJoin our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments