- Home

- Real Estate

- Real Estate Investing

Investors who combine Roth IRAs, the gold standard of tax-free savings, with qualified opportunity funds could enjoy decades of tax-free growth.

By

Michael Kelley

published

18 February 2026

in Features

By

Michael Kelley

published

18 February 2026

in Features

When you purchase through links on our site, we may earn an affiliate commission. Here’s how it works.

- Copy link

- X

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Contact me with news and offers from other Future brands Receive email from us on behalf of our trusted partners or sponsors By submitting your information you agree to the Terms & Conditions and Privacy Policy and are aged 16 or over.You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Signup +

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Signup +

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Signup +

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Signup +

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Signup +

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Signup +

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Signup +

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Signup +

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Signup + An account already exists for this email address, please log in. Subscribe to our newsletter

Whether you are an investor who has maxed out Roth IRAs for decades or someone now racing to catch up, the goal is the same: position as much money as possible for long-term, tax-free growth.

Tax-free investments allow your savings to grow faster and offer more clarity about the assets that will be available to you when you need them. But while taxable and tax-deferred savings are important elements of a financial plan, the value they deliver is subject to the tax rates effective at the time of liquidation.

Future tax rates are unknowable, but we do know that current tax rates are historically low, and that periods of high taxation often follow periods of high national debt.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

CLICK FOR FREE ISSUE

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Sign upThere is a reasonable case to be made that tax rates could be substantially higher in the coming years, further emphasizing the importance of tax-free savings.

Roth IRAs are the gold standard of tax-free savings. They are simple, flexible and truly tax-free for a lifetime, but have hard contribution limits ($7,500 annual contribution in 2026, or $8,600 if you're 50 or older), and income phase-outs.

Even backdoor strategies have limitations. These limits exist for a reason: allowing tax-free growth is a substantial revenue loss for the Treasury.

Unlike Roth IRAs, qualified opportunity funds (QOFs) do not have annual contribution or income limits. Anyone who realizes a capital gain can make an eligible investment in a QOF within 180 days. Whether the gain is $10,000 or $10 million, the full amount is eligible for up to 30 years of tax-free growth.

Thanks to changes enacted in the One Big Beautiful Bill Act (OBBBA) of 2025, opportunity zones just became dramatically more powerful for long-term holders.

About Adviser Intel

The author of this article is a participant in Kiplinger's Adviser Intel program, a curated network of trusted financial professionals who share expert insights on wealth building and preservation. Contributors, including fiduciary financial planners, wealth managers, CEOs and attorneys, provide actionable advice about retirement planning, estate planning, tax strategies and more. Experts are invited to contribute and do not pay to be included, so you can trust their advice is honest and valuable.

Opportunity zones 2.0: OBBBA changes explained

Opportunity zone (OZ) tax incentives were first passed as a temporary program aimed at incentivizing those with recent capital gains to make long-term investments in low-income communities.

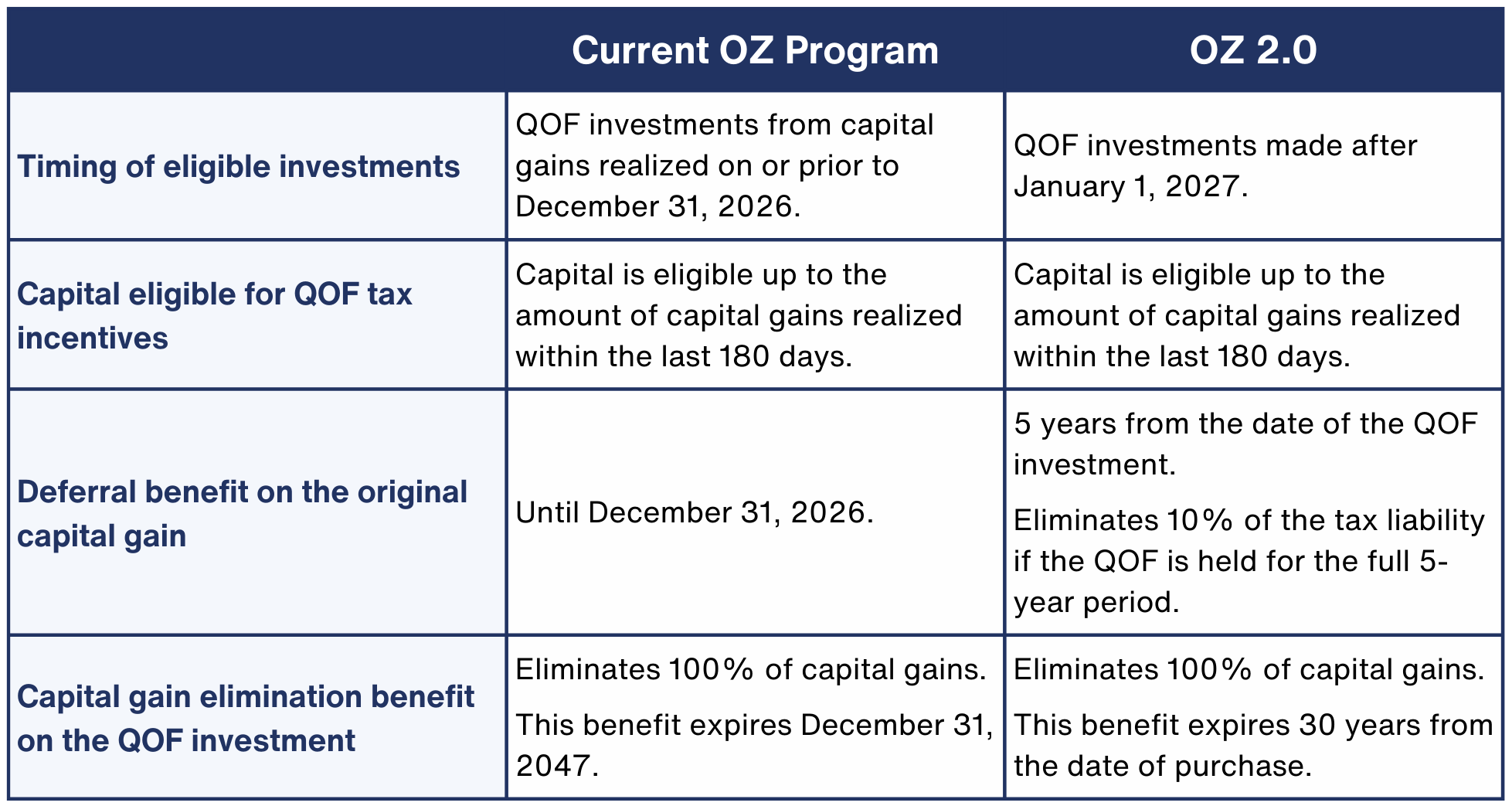

They delivered two benefits: Deferral and partial elimination of the original gain, and total exclusion of post-investment QOF appreciation until 2047, after a 10-year hold. However, as the fixed dates ending the deferral and tax elimination benefits grew nearer, the power of these incentives was substantially eroded.

The OBBBA reforms, informally called "OZ 2.0," fixed that. OZ 2.0's enhanced benefits are available for investments made on or after January 1, 2027.

A bridging strategy: Use OZ 1.0 today to access OZ 2.0 tomorrow

QOF investments made through the end of 2026 still follow OZ 1.0 rules (deferral ends on December 31, 2026). This creates a problem because gains realized before July 2026 will typically have their 180-day QOF investment eligibility expire before the enhanced benefits become available in 2027.

Fortunately, when an investor sells their QOF position, they receive a new capital gains realization date and a fresh 180-day investment window for re-investment and re-deferral in a QOF. This gives investors who originally deferred their gains through an OZ 1.0 investment the opportunity to bridge their eligibility to the enhanced OZ 2.0 benefits.

How qualified opportunity funds work

Realize a capital gain from investments such as stocks, real estate, business sales, cryptocurrency or other qualifying assets.

Within 180 days, invest up to the gain amount into a QOF.

Two ongoing tax benefits then apply:

Five-year deferral + 10% permanent forgiveness. For investments made after December 31, 2026, the original eligible gain is deferred until the earlier of (a) the date you sell your QOF interest or (b) exactly five years after your QOF investment date.

If you hold the QOF for five years, 10% of the original gain is permanently forgiven via a cost basis step-up. This benefit increases to 30% for QOFs focused on rural investments.

30-year benefit: 100% elimination of income from capital appreciation. After holding your QOF investment for at least 10 years, you can elect to step up your cost basis to the full market value at the time of sale.

This is better than simply eliminating the capital gains tax. By electing to have the cost basis equal the sale price for tax purposes, the taxpayer has eliminated the capital gain income itself.

This distinction matters. When future tax laws target capital gains, as the net investment income tax (NIIT) does, there is simply no capital gains income to tax. Zero multiplied by anything is still zero. This benefit continues for up to 30 years from your initial investment date, insulating your wealth against unknown tax regimes decades from now.

Why the 30-year opportunity zone holding period matters

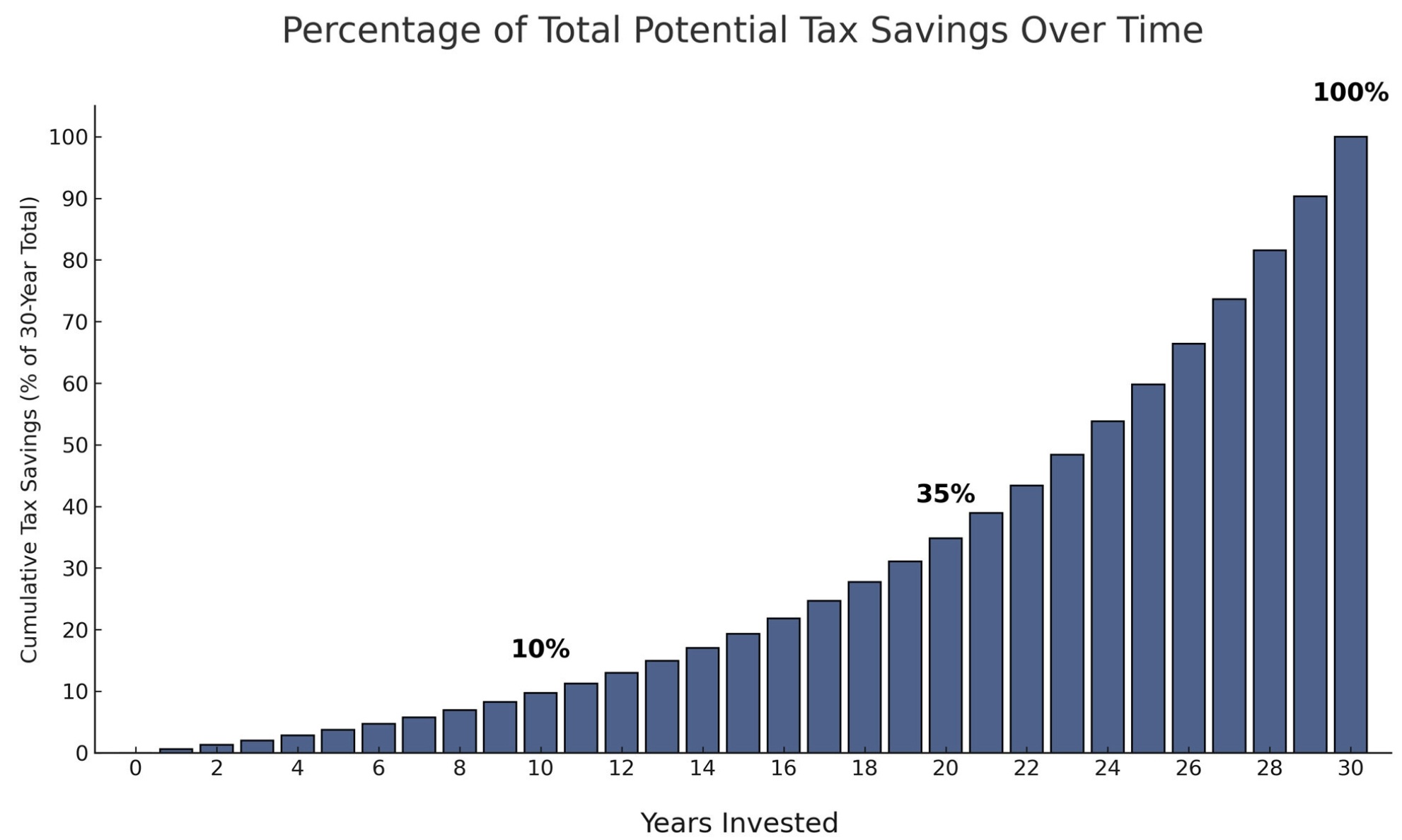

There is no penalty for exiting a QOF, and you can access your money at any time. However, doing so ends the tax incentives. Compound growth, including tax-free compound growth, is not linear, it is heavily backend loaded.

As a result, the potential tax savings and wealth creation are greatest in the outlying years. The graph below illustrates the importance of giving your investment the longest possible runway for tax-free growth.

Percentage of total potential tax savings realized over time with a QOF investment, assuming a 10% growth rate and a 23.8% tax rate (20% capital gains + 3.8% NIIT).

Managing a long-term, tax-efficient QOF

Surprisingly, taxpayers are the only recipients of opportunity zone tax incentives. The operations of the QOF itself are fully taxable. This means that a QOF, regardless of whether it is captive or run for outside investors, needs to be operated in the most tax-efficient manner that is practical if it wants to mimic the tax efficiency of a Roth IRA.

For example, if a QOF partnership decides to sell one of the fund's appreciated properties, regardless of whether the QOF distributes or reinvests the proceeds in another qualified opportunity zone business property, the capital gain realized by the fund will flow through as a taxable capital gain to the investors.

Investors who have held the QOF for less than 10 years will have to pay the tax, potentially without receiving any cash proceeds.

This will step up the investors' cost basis because they paid the tax, completely negating the QOF's step-up benefit they would have received had they held the QOF for 10 years and beyond.

Investors who have held the QOF between 10 and 30 years can elect to use the 100% elimination benefit. They will not incur any tax liability, but by eliminating the gain this portion of their QOF investment converts to being a non-qualifying interest.

With each sale of appreciated property, more and more of the QOF investors' capital will convert to non-qualifying status.

As a result, the turning over of appreciated QOF assets can be highly detrimental from a tax standpoint. This is why it is important for any fund trying to mimic a Roth IRA's tax efficiency to adopt a buy-and-hold strategy.

To achieve this outcome, it is important to align the QOF manager's compensation with tax-efficient outcomes, including eliminating promoted interests (aka carried interest), which reward the sale of appreciated assets.

Likewise, income from operations is also taxable, so QOF managers will want to rely on depreciation and mortgage interest deductions to mitigate taxable income from operations whenever possible.

A long-term tax-efficient QOF should:

- Minimize the realization of capital gains inside the fund (pure buy-and-hold real estate)

- Eliminate carried-interest structures that reward selling appreciated assets

- Use depreciation and interest deductions to shelter cash flow

Taken together, these steps allow a QOF to more closely approximate the long-term tax efficiency of a Roth IRA.

Looking for expert tips to grow and preserve your wealth? Sign up for Adviser Intel, our free, twice-weekly newsletter.

Risks and limitations to qualified opportunity zone investments

Opportunity zones offer powerful benefits but are not risk-free. Investments may be illiquid (a minimum 10-year hold is required for the 100% tax elimination benefit), subject to price volatility and potential permanent loss of capital, concentrated within specific census tracts, and exposed to managerial, operational and legislative risk (as a future Congress could modify the rules).

As always, past performance is no guarantee of future results, and investors should consult qualified tax and legal advisers.

Conclusion: The one-two punch of a Roth IRA plus a QOF

These tools complement each other well. Roth IRA accounts offer unmatched comprehensive tax-free treatment for any number of investments. Although QOFs offer narrower protections, they enable investors to increase their tax-free savings at levels that exceed Roth contribution limits.

The Roth IRA will remain the primary workhorse of tax-free investing. However, now that QOF tax incentives have shed their temporary status, they should be recognized as a valuable tool for constructing tax-efficient financial plans.

QOFs offer the potential for decades of tax-free growth and are broadly applicable, with capital gains of any size qualifying. Together, they enable a greater share of your savings to compound tax-free.

The author is the founder and CEO of Park View OZ (PVOZ), a publicly traded perpetual-life qualified opportunity fund.

Related Content

- Five Strategies to Defer Capital Gains in Real Estate Investing

- 1031 Exchanges vs Opportunity Zones: Which Has the Edge?

- Opportunity Zones: An Expert Guide to the Changes in the One Big Beautiful Bill

- I'm a Real Estate Expert: 2026 Marks a Seismic Shift in Tax Rules, and Investors Could Reap Millions in Rewards

- A Compelling Case for Why Property Investing Reigns Supreme, From a Real Estate Investing Pro

This article was written by and presents the views of our contributing adviser, not the Kiplinger editorial staff. You can check adviser records with the SEC or with FINRA.

TOPICS Adviser Intel Get Kiplinger Today newsletter — freeContact me with news and offers from other Future brandsReceive email from us on behalf of our trusted partners or sponsorsBy submitting your information you agree to the Terms & Conditions and Privacy Policy and are aged 16 or over. Michael KelleySocial Links NavigationCEO, Park View OZ

Michael KelleySocial Links NavigationCEO, Park View OZMichael Kelley is Founder and CEO of Park View Investments and Park View OZ (PVOZ), the leader in OZ tax planning. He was an early mover in Opportunity Zones, recognizing the program's potential to redirect capital flows into underserved communities while delivering substantial tax benefits to investors. With over 30 years of experience in capital markets and real estate investment, he founded PVOZ to provide investors access to the full 30-year tax elimination benefits through a publicly traded REIT structure.

Latest You might also like View More \25b8

Why a Midcareer Pivot Can Be a Wealth-Building Power Move

Why a Midcareer Pivot Can Be a Wealth-Building Power Move

Stocks Make More Big Up and Down Moves: Stock Market Today

Stocks Make More Big Up and Down Moves: Stock Market Today

8 Ways Mahjong Can Teach Us How to Manage Our Money

8 Ways Mahjong Can Teach Us How to Manage Our Money

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Looking for a Financial Book That Won't Put Your Young Adult to Sleep? This One Makes 'Cents'

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

Global Uncertainty Has Investors Running Scared: This Is How Advisers Can Reassure Them

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

I'm a Real Estate Investing Pro: This Is How to Use 1031 Exchanges to Scale Up Your Real Estate Empire

My Spouse and I Are Saving Money for a Down Payment on a House. Which Savings Account is the Best Way to Reach Our Goal?

My Spouse and I Are Saving Money for a Down Payment on a House. Which Savings Account is the Best Way to Reach Our Goal?

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In

Should You Jump on the Roth Conversion Bandwagon? A Financial Adviser Weighs In