- Home

- Retirement

- Estate Planning

Illinois' estate tax "threshold" (rather than "exemption") can surprise families, but proactive planning can help preserve more for heirs and charitable causes.

By

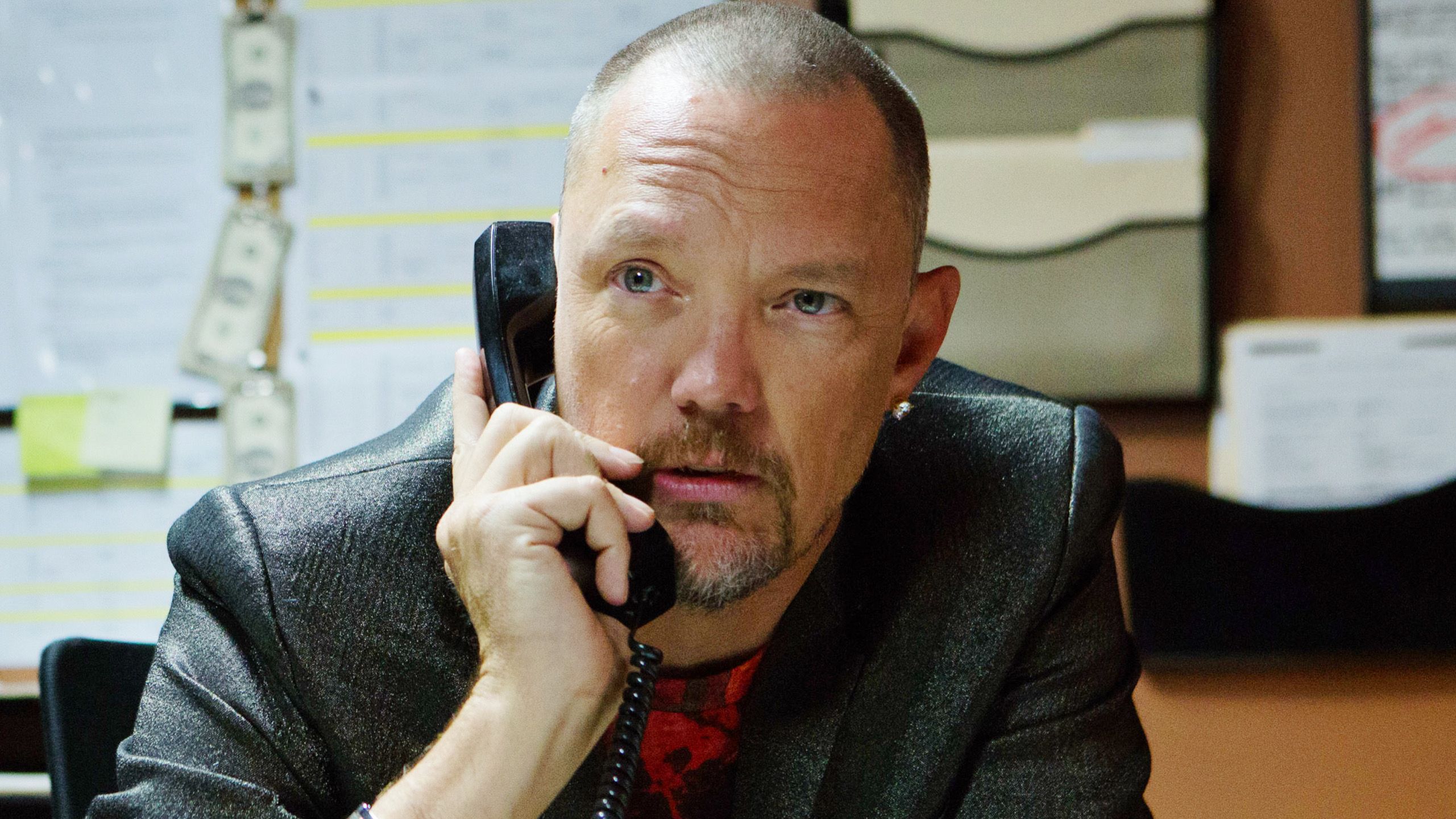

Scott Tucker, Investment Adviser Representative

published

13 February 2026

in Features

By

Scott Tucker, Investment Adviser Representative

published

13 February 2026

in Features

When you purchase through links on our site, we may earn an affiliate commission. Here’s how it works.

- Copy link

- X

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Contact me with news and offers from other Future brands Receive email from us on behalf of our trusted partners or sponsors By submitting your information you agree to the Terms & Conditions and Privacy Policy and are aged 16 or over.You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Delivered daily

Kiplinger Today

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more delivered daily. Smart money moves start here.

Signup +

Sent five days a week

Kiplinger A Step Ahead

Get practical help to make better financial decisions in your everyday life, from spending to savings on top deals.

Signup +

Delivered daily

Kiplinger Closing Bell

Get today's biggest financial and investing headlines delivered to your inbox every day the U.S. stock market is open.

Signup +

Sent twice a week

Kiplinger Adviser Intel

Financial pros across the country share best practices and fresh tactics to preserve and grow your wealth.

Signup +

Delivered weekly

Kiplinger Tax Tips

Trim your federal and state tax bills with practical tax-planning and tax-cutting strategies.

Signup +

Sent twice a week

Kiplinger Retirement Tips

Your twice-a-week guide to planning and enjoying a financially secure and richly rewarding retirement

Signup +

Sent bimonthly.

Kiplinger Adviser Angle

Insights for advisers, wealth managers and other financial professionals.

Signup +

Sent twice a week

Kiplinger Investing Weekly

Your twice-a-week roundup of promising stocks, funds, companies and industries you should consider, ones you should avoid, and why.

Signup +

Sent weekly for six weeks

Kiplinger Invest for Retirement

Your step-by-step six-part series on how to invest for retirement, from devising a successful strategy to exactly which investments to choose.

Signup + An account already exists for this email address, please log in. Subscribe to our newsletter

Illinois remains one of the few states that still imposes its own estate tax, and its rules are very different from the federal system's.

The federal estate tax exempts $15 million per person, or $30 million per married couple. Illinois uses a much lower $4 million estate tax threshold per married couple.

The word "threshold" matters: It's not a true exemption. If an estate is valued at $4 million or less, there is no Illinois estate tax. But if the value exceeds $4 million by even a single dollar, Illinois will tax the entire estate, not just the amount above the threshold.

From just $107.88 $24.99 for Kiplinger Personal Finance

Become a smarter, better informed investor. Subscribe from just $107.88 $24.99, plus get up to 4 Special Issues

CLICK FOR FREE ISSUE

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

Sign upThis is known as the Illinois "cliff tax." At an estate value of exactly $4 million, the tax is zero. But at $4 million plus $1, the entire estate is taxable.

An estate just barely above the threshold, at, say, $4.1 million, might trigger about $200,000 to $240,000 of Illinois estate tax under current estimates, even though it exceeded the threshold by only $100,000. (This example is for illustration only.)

Many Illinois residents find themselves approaching the threshold without realizing it. After decades of saving, home appreciation and life insurance growth, it is common for ordinary families to exceed $4 million.

For example, a married couple with a $1.2 million home, $2.4 million in retirement savings and a $1 million life insurance policy (which would be taxable in certain circumstances) would be over the threshold, even though few people in that position would describe themselves as very wealthy.

About Adviser Intel

The author of this article is a participant in Kiplinger's Adviser Intel program, a curated network of trusted financial professionals who share expert insights on wealth building and preservation. Contributors, including fiduciary financial planners, wealth managers, CEOs and attorneys, provide actionable advice about retirement planning, estate planning, tax strategies and more. Experts are invited to contribute and do not pay to be included, so you can trust their advice is honest and valuable.

Avoiding the loss of a second threshold

A further complication arises with married couples. Under federal law, the unused portion of the first spouse's exemption automatically transfers to the surviving spouse.

Illinois does not allow this portability. If nothing is done before the first spouse dies, the unused portion of the first spouse's threshold is permanently lost.

In effect, many married couples unintentionally end up with only a single $4 million threshold rather than two.

That is why a credit shelter trust — sometimes called a bypass trust — could be the most important estate planning tool in Illinois. A properly drafted estate plan can preserve the first spouse's threshold and keep it available for the surviving spouse.

When implemented correctly, this strategy may effectively increase the Illinois protection to about $8 million per married couple, not just $4 million. Without planning, the second threshold disappears.

A simple will does not accomplish this. A will directs distribution, but it does not preserve the first spouse's threshold. A revocable living trust with Illinois-specific estate tax provisions, or a credit shelter trust triggered at the first death, is necessary for married couples approaching or exceeding the Illinois threshold.

It is also important to know what Illinois counts in determining whether the threshold has been exceeded. The state includes homes, investment property, bank and brokerage accounts, retirement accounts, business interests, farmland, personal property and life insurance death benefits if the insured owns the policy.

A family who appear "comfortable but not wealthy" during life could find themselves well into taxable territory at death.

Strategies to reduce or manage Illinois estate tax exposure

Once the Illinois threshold is crossed, the state applies a progressive estate tax rate that ranges up to the midteens. That is why planning and timing matter so much.

Life insurance is particularly critical, because a policy owned by the insured is part of the taxable estate and may push the estate over the threshold instantly at death. An irrevocable life insurance trust (ILIT) can own the policy instead, keeping the death benefit outside the taxable estate.

Charitable strategies can also help reduce the taxable estate while supporting causes families care about. Donor-advised funds (DAFs), charitable trusts and direct bequests can shift assets away from the taxable estate.

Illinois does not impose a separate state-level gift tax, so lifetime gifting may be an effective way to reduce exposure over time.

Relocation is sometimes worth considering, because states like Florida, Tennessee and Texas impose no state estate tax. But establishing domicile requires more than a change of address, and Illinois property or business ownership may still create planning obligations.

Always seek legal counsel regarding domicile and state law nuances.

Looking for expert tips to grow and preserve your wealth? Sign up for Adviser Intel, our free, twice-weekly newsletter.

Timing matters more than you think

Perhaps the most important point is timing. The moment of the first spouse's death determines whether the second threshold will be preserved or lost. Planning must be done in advance.

Even families currently worth well under $4 million should remember that assets compound. Even if your estate is only $1 million today, it could be $4 million or more 20 years from now due to investment growth and rising property values.

Without proactive planning, that growth could push an otherwise modest estate into taxable territory.

The Illinois estate tax is not an issue only for the wealthy. It increasingly affects middle- and upper-middle-income Illinois families who have saved responsibly, purchased insurance and owned real estate for many years.

Understanding that Illinois uses a $4 million per couple threshold — not a true exemption — and that crossing the threshold by even $1 means Illinois will tax the entire estate, is essential.

With thoughtful planning, particularly via a credit shelter trust, many couples can effectively secure about $8 million of protection and keep substantially more of their estate for spouses, children and charitable causes rather than sending an unnecessary share to the state.

This article is for informational purposes only and should not be considered tax or legal advice. Individuals should consult qualified legal and tax professionals regarding their specific circumstances. The hypothetical examples provided are illustrative only and do not guarantee or predict any specific outcome.

The appearances in Kiplinger were obtained through a PR program. The columnist received assistance from a public relations firm in preparing this piece for submission to Kiplinger.com. Kiplinger was not compensated in any way.

Related Content

- Illinois Tax Guide

- States That Won't Tax Your Retirement Income in 2026

- 10 Least Tax-Friendly States for Middle-Class Families

- The Minimum Savings You Need to Retire in All 50 States

- 12 Great Places to Retire in the Midwest

The Accredited Investment Fiduciary (AIF®) Designation demonstrates the individual has met educational standards to carry out a fiduciary standard of care and acting in a client's best interest. National Social Security Advisor Certificate Program (NSSA) is a certification created by the National Social Security Association, a for-profit entity. The NSSA Certificate Program grants a Certificate to those who complete the one-day course and pass the proctored assessment. NSSA is independently accredited by The Institute in Credentialing Excellence (ICE). NSSA is not affiliated with, nor endorsed by, the Social Security Administration or any governmental agency. Insurance products are offered through the insurance business Scott Tucker Solutions, Inc. Scott Tucker Solutions, Inc is also an Investment Advisory practice that offers products and services through AE Wealth Management, LLC (AEWM), a Registered Investment Adviser. AEWM does not offer insurance products. The insurance products offered by Scott Tucker Solutions, Inc are not subject to Investment Adviser requirements. Neither the firm nor its agents or representatives may give tax or legal advice. Individuals should consult with a qualified professional for guidance before making any purchasing decisions. 3627205 - 1/26

DisclaimerThis article was written by and presents the views of our contributing adviser, not the Kiplinger editorial staff. You can check adviser records with the SEC or with FINRA.

TOPICS Adviser Intel Get Kiplinger Today newsletter — freeContact me with news and offers from other Future brandsReceive email from us on behalf of our trusted partners or sponsorsBy submitting your information you agree to the Terms & Conditions and Privacy Policy and are aged 16 or over. Scott Tucker, Investment Adviser RepresentativeSocial Links NavigationPresident and Founder, Scott Tucker Solutions

Scott Tucker, Investment Adviser RepresentativeSocial Links NavigationPresident and Founder, Scott Tucker SolutionsScott Tucker is president and founder of Scott Tucker Solutions, Inc. He has been helping Chicago-area families with their finances since 2010. A U.S. Navy veteran, Scott served five years on active duty as a cryptologist and was selected for duty at the White House based on his service record. He holds life, health, property and casualty insurance licenses in Illinois, has passed the Series 65 securities exam in 2015 and is an Investment Adviser Representative.

Latest You might also like View More \25b8

Money Questions Couples Should Ask Before Combining Finances or Planning a Future Together

Money Questions Couples Should Ask Before Combining Finances or Planning a Future Together

Ask the Tax Editor: IRAs

Ask the Tax Editor: IRAs

At-Fault States Where No-Fault Insurance Still Applies

At-Fault States Where No-Fault Insurance Still Applies

4 Pro Tips for Successfully Scaling the Medicare Mountain

4 Pro Tips for Successfully Scaling the Medicare Mountain

For More Flexible Giving, Consider Combining a Charitable Remainder Trust With a Donor-Advised Fund

For More Flexible Giving, Consider Combining a Charitable Remainder Trust With a Donor-Advised Fund

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

AI Unwind Takes 2% Off the Nasdaq: Stock Market Today

Big Change Coming to the Federal Reserve

Big Change Coming to the Federal Reserve

January CPI Report Shows Inflation Slowed. Here's What That Means for Rate Cuts

January CPI Report Shows Inflation Slowed. Here's What That Means for Rate Cuts

How to Open Your Kid's $1,000 Trump Account

How to Open Your Kid's $1,000 Trump Account

Why 'Locking' Your Social Security Number Is the New Credit Freeze

Why 'Locking' Your Social Security Number Is the New Credit Freeze

These Thoughtful Retirement Planning Steps Help Protect the Life You Want in Retirement

These Thoughtful Retirement Planning Steps Help Protect the Life You Want in Retirement