As mortgage rates remain lower and buyers continue to have the upper hand in most markets across the U.S., many are opting out of paying for homes in cash.

Inman On Tour

Inman On Tour Nashville delivers insights, networking, and strategies for agents and leaders navigating today’s market.

Inman On Tour Nashville delivers insights, networking, and strategies for agents and leaders navigating today’s market.

Fewer buyers are seeing cash as an appealing way to pay for a home as mortgage rates decline.

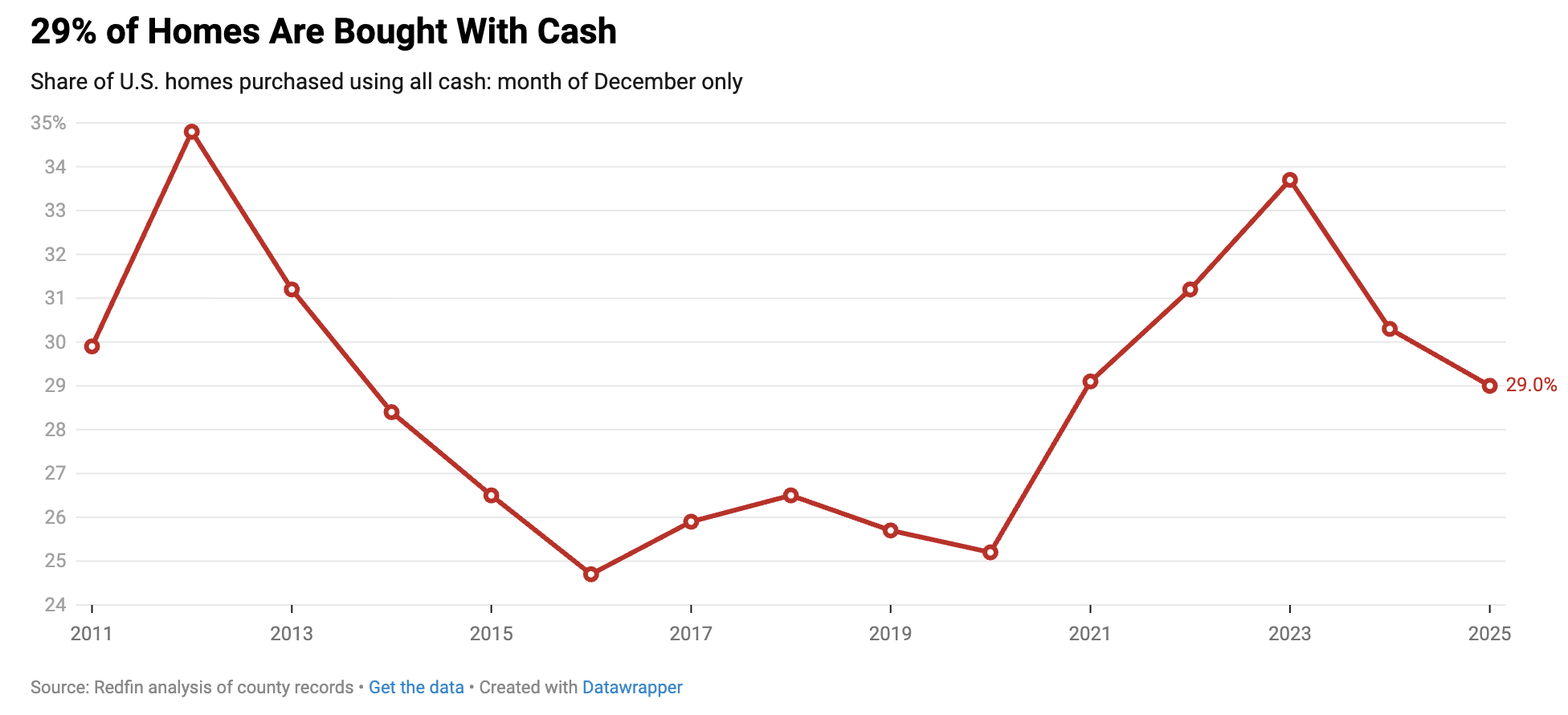

In December 2025, just 29 percent of buyers paid for homes in cash, which is the lowest share for any December since 2020, according to an analysis of the 38 most populous metros in the U.S. by Redfin.

In December 2024, 30.3 percent of homebuyers paid in cash, but the share of all-cash buyers peaked in 2023 at almost 35 percent as mortgage rates also hit a high in the 7 percent range and buyers sought to avoid paying interest at those higher rates.

The number of cash buyers has also declined because real estate is currently seeing its strongest buyer’s market in a long time. Therefore, because sellers outnumber buyers, buyers don’t have to work so hard to win properties through the extreme tactics of the pandemic market, like offering to pay in cash or waiving inspections.

Even so, buyers who are willing to pay cash now may be able to get a better deal because sellers are so eager to offload their properties in this market.

“The leverage buyers have when they pay in cash is unbelievable,” Dallas Redfin Premier agent Amanda Peterson said in Redfin’s report. “It’s not uncommon to see a buyer score a home for 10 to 20 percent below the appraised value if they offer cash.”

All-cash purchases were most common in West Palm Beach, Florida, in December, with 47.2 percent of buyers paying in cash. After that, cash purchases were most frequent in Jacksonville, Florida, and Miami, Florida, where 39.3 percent of buyers paid in cash.

The lowest number of cash buyers transacted in Seattle, Washington (17.3 percent of buyers); Oakland, California (18.5 percent) and Sacramento, California (19.6 percent).

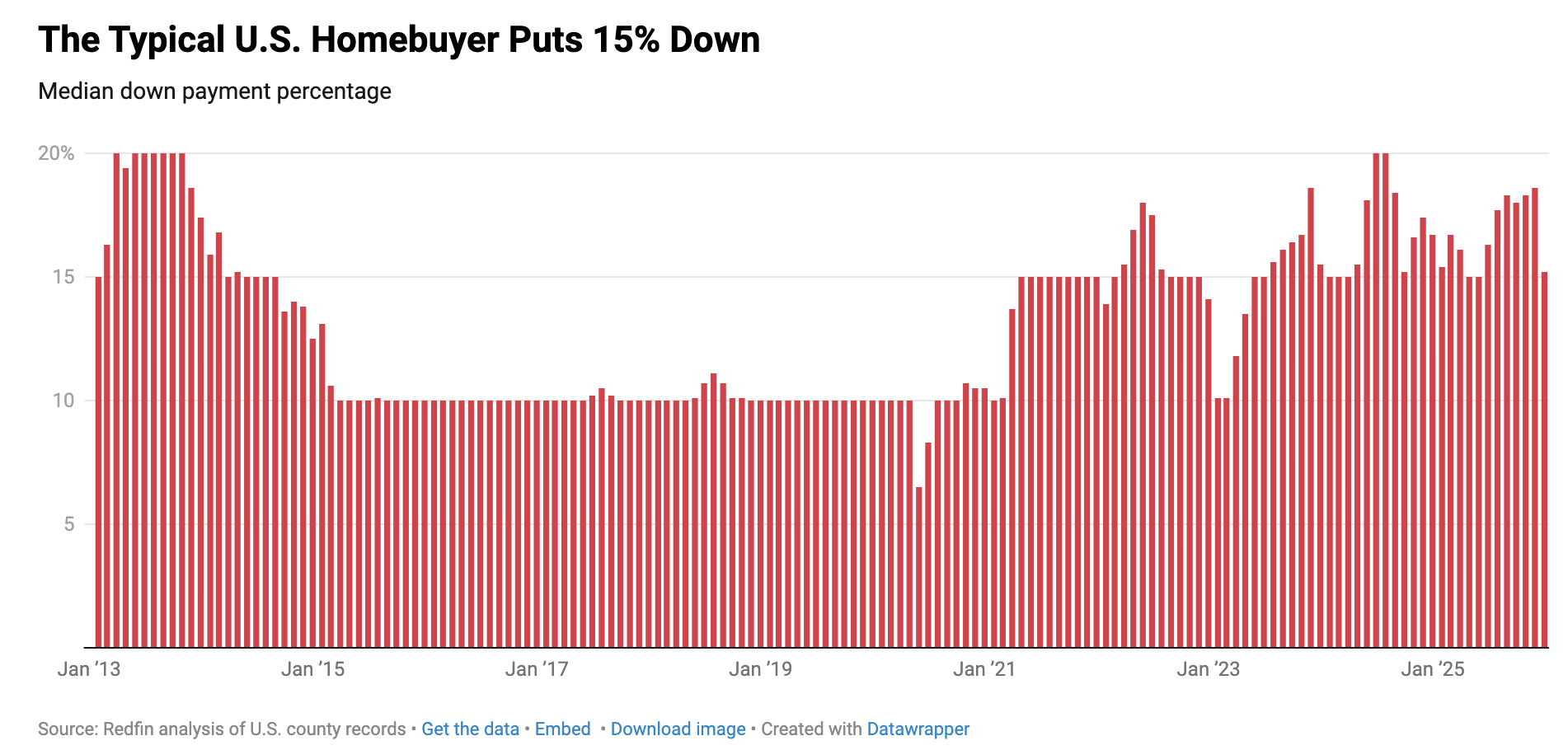

For those homebuyers who did take out mortgages, down payments also ticked down by 1.5 percent year over year in December to $64,000, as higher homebuying costs and more market leverage spurred buyers to put down less money upfront.

That month, the typical homebuyer put down 15.2 percent of the home sales price compared to 16.7 percent the year prior.

The decline in down payment amount marked the first such drop in the past five months, according to a separate Redfin report.

That decrease in down payments is just another sign that buyers are pinching their pennies while they hold the upper hand in the market.

“Down payments may be falling in part because Americans are seeking out more affordable homes due to high prices, elevated mortgage rates and economic uncertainty,” Redfin Principal Economist Sheharyar Bokhari said in the company’s report. “Sellers typically prefer buyers who make large down payments because it signals financial stability, but sellers don’t have much say in today’s market. Buyers hold the negotiating power because there are more homes for sale than people who want to buy them.”

With mortgage rates now near a low not seen since 2022, more buyers may be encouraged to get back into the market this year.

The median down payment fell the most sharply in Orlando, Florida, where it decreased by 23.9 percent year over year in December. Cincinnati, Ohio (-22.6 percent), and Atlanta, Georgia (-18.9 percent), saw the second- and third-largest declines.

Meanwhile, the median down payment increased the most year over year in Cleveland, Ohio, where it was up by 31.7 percent. Providence, Rhode Island (up 20.4 percent), and Baltimore, Maryland (up 20 percent), saw the next most significant annual increases.

Email Lillian Dickerson

Topics: buyer's agent | homebuying | lenders | Redfin Show Comments Hide Comments Sign up for Inman’s Morning Headlines What you need to know to start your day with all the latest industry developments Sign me up By submitting your email address, you agree to receive marketing emails from Inman. Success! Thank you for subscribing to Morning Headlines. Read Next He's been at the MBA and Fannie Mae. Here's who he thinks has the better 2026 mortgage forecast

He's been at the MBA and Fannie Mae. Here's who he thinks has the better 2026 mortgage forecast

Here's how much homebuyer affordability has improved this year

Here's how much homebuyer affordability has improved this year

Existing-home sales tank 8.4% in January amid winter chill

Existing-home sales tank 8.4% in January amid winter chill

Why does everybody suddenly care about affordability? The Download

More in Markets & Economy

Why does everybody suddenly care about affordability? The Download

More in Markets & Economy

Opendoor pushes AI pivot amid stock volatility

Opendoor pushes AI pivot amid stock volatility

What to do when it takes longer to sell your listings: Now Streaming

What to do when it takes longer to sell your listings: Now Streaming

Zacks analyst: Zillow earnings suggest 2026 market to be a 'bust'

Zacks analyst: Zillow earnings suggest 2026 market to be a 'bust'

Why the FHFA’s latest move puts fair housing at risk

Why the FHFA’s latest move puts fair housing at risk

Read next

Read Next

Zillow files shed light on how it viewed Compass' technology

Zillow files shed light on how it viewed Compass' technology

Here's how much homebuyer affordability has improved this year

Here's how much homebuyer affordability has improved this year

7 AI tools that help agents do in hours what used to take days

7 AI tools that help agents do in hours what used to take days

Why does everybody suddenly care about affordability? The Download

Why does everybody suddenly care about affordability? The Download